GOVERNMENT backtracking on tax rises for public houses and other hospitality venues has not gone far enough, said West Somerset MP Rachel Gilmour.

Mrs Gilmour said the announcement of a 15 per cent discount on this year’s business rates bills for all pubs and music venues was too little to make any significant difference.

The Government said there would also be a two-year real-terms freeze in business rates and a review of the method used to value the business premises.

A new ‘High Street Strategy’ was also announced to help retail, leisure, and hospitality businesses thrive as the ‘bedrock of strong communities’.

But Mrs Gilmour said more needed to be done and she would continue to campaign for extra support for hospitality businesses in her Tiverton and Minehead constituency.

She said: “Although I welcome elements of this support package from the Government, the reality is that a 15 per cent discount, the equivalent saving of £1,650, is nowhere near enough for our small and medium-sized hospitality businesses, who are already dealing with rising costs.”

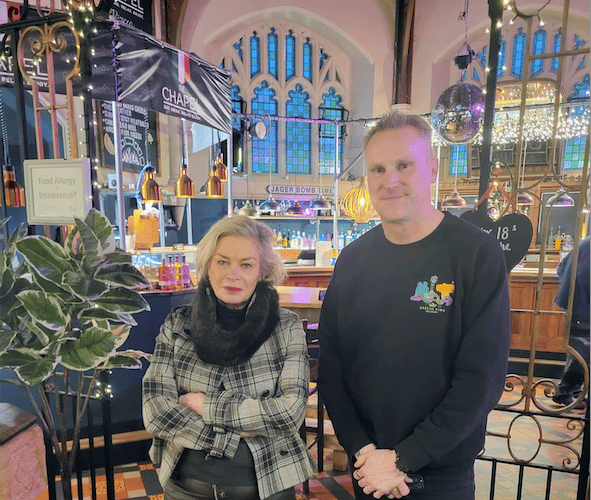

Only last week, Mrs Gilmour visited The Chapel, a Cotford St Luke pub converted from a former church building, to discuss the industry’s troubles with landlord Steve Elliott.

Mr Elliott recently appealed on social media for more local people to use the pub or he would have to close it.

He said a ‘significant increase in local support’ was needed or ‘the reality is closure in the short-term is a very real risk’.

Mr Elliott quoted the impact of business rate increases due from April 1 as one of the reasons for his pub’s struggles.

Mrs Gilmour said she had heard from many owners of pubs, restaurants, cafes, and other hospitality venues in the constituency who were similarly struggling.

She called for people to sign her online petition supporting local small and medium-sized businesses.

Comments

This article has no comments yet. Be the first to leave a comment.